| Life stage | Grow Wrap benefits |

|---|---|

Starting out |

Essentials package allows you to accumulate wealth with a comprehensive list of managed funds, cash account and Term Deposits – all at low fees. |

Growing income and wealth |

You have the option to access extra managed funds and/or ASX-listed securities to further tailor your portfolio. |

Starting a family |

Grow Wrap Super offers the ability to tailor a comprehensive insurance solution to your needs. |

Growing with other family members |

A 20 percent discount2 for parents, children and grandparents of the same family and related entities such as family trusts and SMSFs. |

Transitioning to retirement |

Seamless transition between super and pension, saving you on transaction costs. |

Keeping it in the family |

Estate Planning solutions through Grow Wrap Super and Pension which allow you and your loved ones to gain access to:

|

All in one wrap solution

Grow Wrap is a wrap solution with the flexibility to grow with you, from your first job to retirement and beyond. It offers you:

- seamless super, pension and investment management solutions

- market-leading insurance and estate planning options

- easy access to your account information online - anytime, anywhere and on any device1.

- competitive fees, where you only pay for what you use

- additional 20 percent family discount2

Product features

Adapts with your needs

Diverse range of investment options

Every investor’s needs are unique. That’s why Grow Wrap offers you cost-effective and flexible investment management options that can be tailored to your changing needs.

This competitive ‘unbundled’ fee structure allows you and your adviser to match Grow Wrap’s investment and insurance solutions to your specific life stage and budget.

Essentials package

Access around 80 Managed Funds, including a wide range of ANZ and Macquarie Term Deposits and a dynamic Cash Account.

Optional extra packages

For more tailored options, simply add ‘Optional Extras’ which gives you access to a broader menu of managed funds and/or Separately Managed Accounts (SMAs) and/or a share trading facility for ASX-listed securities, including Exchange Traded Funds (ETFs).

Market-leading insurance

With Grow Wrap Super, you can access OnePath’s award-winning OneCare range of insurance solutions. OneCare provides a comprehensive range of insurance cover options which can give you the peace of mind that you and your dependants will be looked after, should the unexpected occur.

You can access the following types of insurance:

- Life Cover (including Terminal Illness)

- TPD Cover

- Income Secure Cover

- Extra Care Cover (consisting of Accidental Death and Terminal Illness)

Access your account information any time

You can easily keep track of your Grow Wrap portfolio online, at any time and on any device through our secure web portal, the online portal1.

The online portal gives you a snapshot of your investments at the click of a button. It also allows you to view reports and account information including:

- your portfolio investments and their value

- all transactions on your account, from inception

- your asset allocation and weightings, and

- any income received and all expenses charged to your account.

How Grow Wrap works

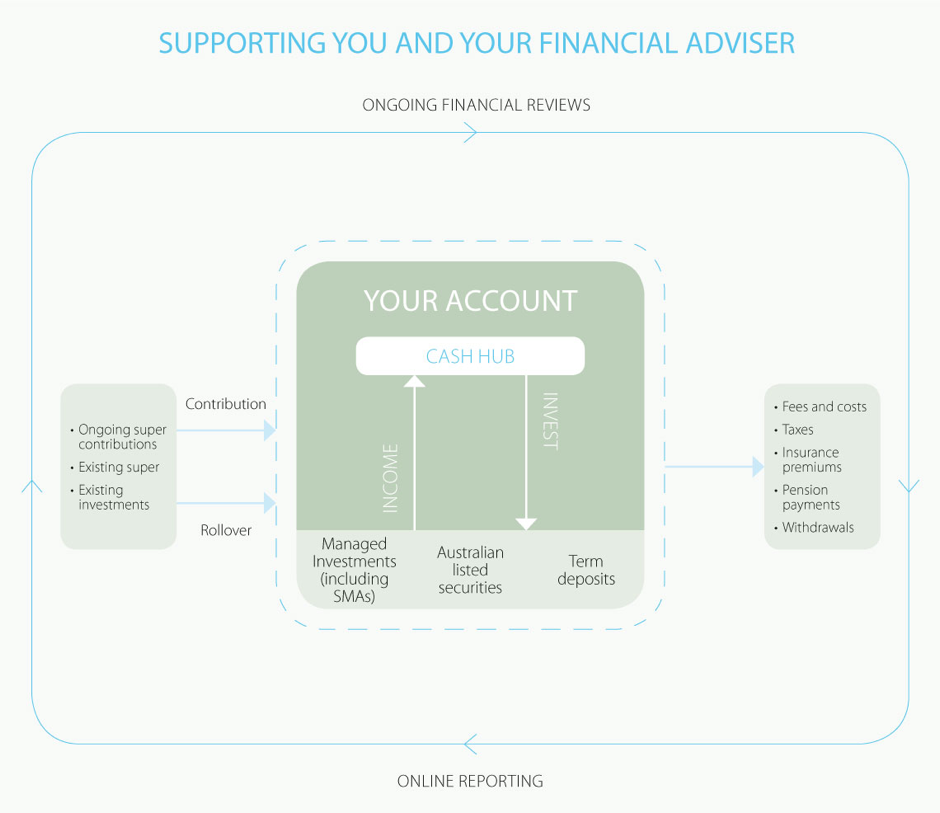

Grow Wrap is designed for investors who want to take control of their super, pension and personal investments with the help of their financial adviser.

With Grow Wrap, you and your financial adviser can take full control without the burden of manual administration and paperwork.

With Grow Wrap you can choose from the following:

Grow Wrap Super Service

A flexible and tax-effective solution for your retirement where you, your employer or spouse can make contributions.

Grow Wrap Super may be suitable for employees, the self-employed or if you are considering rolling over your superannuation savings prior to retirement.

Grow Wrap Pension Service

Seamlessly move super savings from the Grow Wrap Super Service into an account-based pension without the need to sell down assets.

This service may be suitable for customers with existing pension investments. Transition to Retirement (TTR) pensions are also available for investors wanting a tailored solution to effectively transition towards retirement.

Grow Wrap Investment Service

Allows you to invest in a wide range of professionally managed investment options and ASX listed securities that meet your changing needs. This service can be used by individuals, self-managed super funds, trusts, companies and joint investors.

Looking for more information?

Online

Email customer@wrapinvest.com.au

Or speak with your financial adviser

Downloads and links